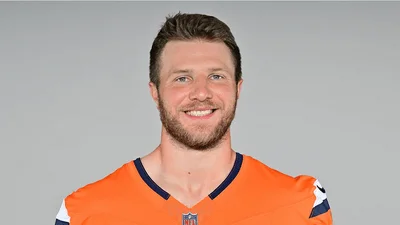

State Rep. Ken Borton | Michigan House Republicans

State Rep. Ken Borton | Michigan House Republicans

State Representative Ken Borton, a Republican from Gaylord, is urging action on a recently introduced plan that would lower the state income tax rate to 3.9%. The aim is to provide relief to families who are struggling to keep up with the high cost of living. Borton's call comes as tax-filing season begins in Michigan, with some filers expected to receive higher-than-expected returns due to a temporary reduction in the state income tax rate implemented by Republicans. However, Lansing Democrats have pushed for taxes to be raised again in 2024.

Borton criticized the Democrats, stating, "Democrats are proving that even if someone only has two nickels to their name, they'll happily take both under the guise of helping vulnerable people." He emphasized the need for more substantial tax relief for vulnerable individuals who are facing a mountain of bills caused by inflation. Borton also highlighted the state's substantial revenue surplus and argued that it is well within its means to provide tax relief for working people.

The Republican plan, known as House Bill 5399, seeks to fulfill a promise made during the administration of former Governor Jennifer Granholm to restore the income tax rate to 3.9%. In 2007, as part of a legislative deal, the income tax rate was temporarily increased to 4.35% to avoid a government shutdown. The plan was for the rate to decrease to 3.9% by 2015, but it never happened. The rate was later reduced to 4.25% in 2012 and temporarily lowered to 4.05% in 2023. Under Democratic leadership, the tax rate will rise to 4.25% again in 2024.

Borton expressed his disappointment, stating, "Folks across Michigan were promised a lower income tax, but the state never delivered." He argued that the Republican plan to lower the income tax fulfills that promise to voters. Borton criticized the governor and Lansing Democrats, accusing them of imposing higher taxes to fund their plan to assist wealthy individuals in purchasing electric vehicles. He expressed concern that Democrats prioritize helping the wealthy afford luxury cars over providing tax relief for the working class.

Supporting Borton's argument, data compiled by the Mackinac Center for Public Policy shows that states with income tax rates below 4% have experienced a 5.7% increase in jobs since the pandemic, surpassing pre-pandemic levels. In contrast, states with income tax rates of 4% or higher have only seen a 2% increase in job numbers. Michigan lags even further behind, with the state still 0.6% below its pre-pandemic job numbers.

House Bill 5399 has been referred to the House Government Operations Committee, which has a reputation for being historically unproductive.

Alerts Sign-up

Alerts Sign-up